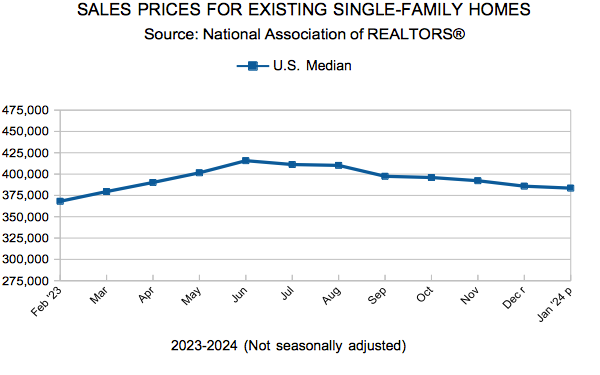

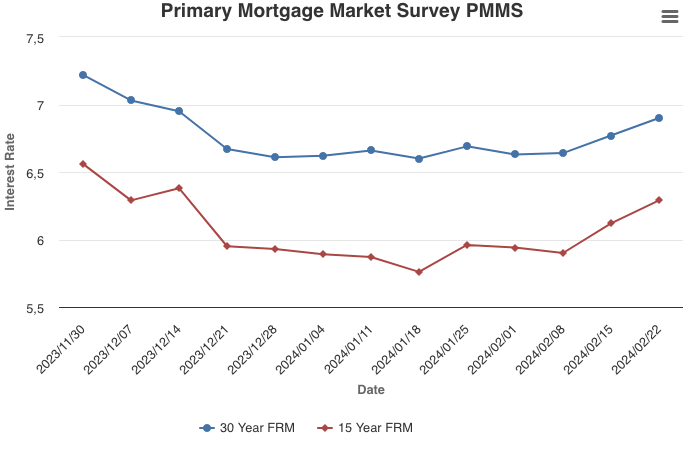

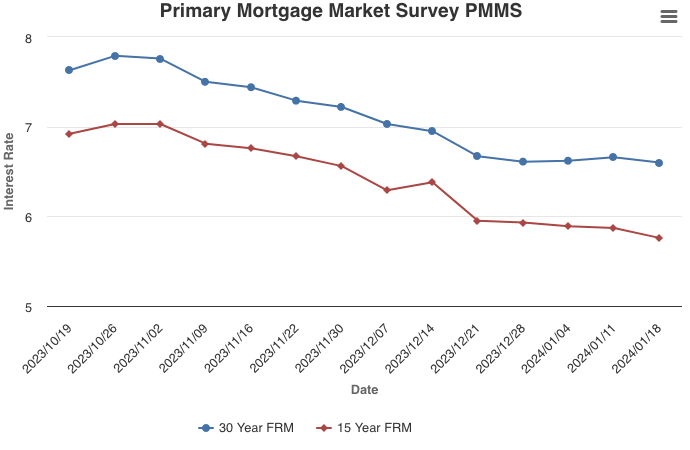

Mortgage Rates Continue to Rise, Nearing Seven Percent

February 22, 2024

Strong incoming economic and inflation data has caused the market to re-evaluate the path of monetary policy, leading to higher mortgage rates. Historically, the combination of a vibrant economy and modestly higher rates did not meaningfully impact the housing market. The current cycle is different than historical norms, as housing affordability is so low that good economic news equates to bad news for homebuyers, who are sensitive to even minor shifts in affordability.

Information provided by Freddie Mac.

January Monthly Skinny Video

Mortgage Rates Rise

February 15, 2024

On the heels of consumer prices rising more than expected, mortgage rates increased this week. The economy has been performing well so far this year and rates may stay higher for longer, potentially slowing the spring homebuying season. According to Freddie Mac data, mortgage applications to buy a home so far in 2024 are down in more than half of all states compared to a year earlier.

Information provided by Freddie Mac.

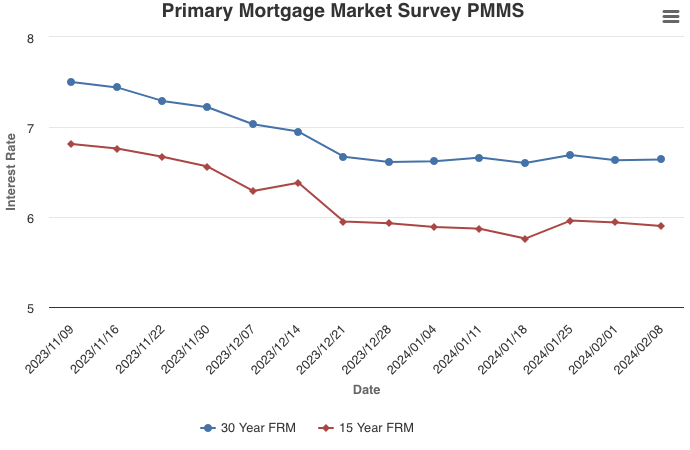

Mortgage Rates Show Little Movement

February 8, 2024

Mortgage rates remain stagnant, hovering in the mid-six percent range over the past several weeks. The economy and labor market remain strong with wage growth outpacing inflation, which is keeping consumer spending robust. Meanwhile, affordability in the housing market is an ongoing issue due to continued high home prices, elevated mortgage rates and low supply of homes on the market, particularly for first-time and low-income homebuyers.

Information provided by Freddie Mac.

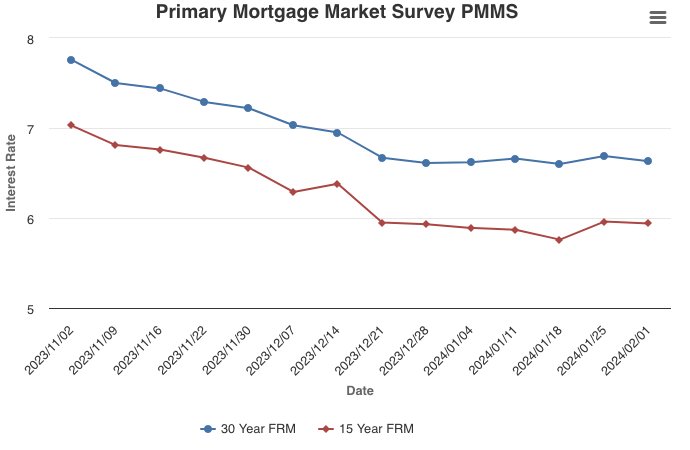

Mortgage Rates Tick Down

February 1, 2024

Although affordability continues to impact homeownership, the combination of a solid economy, strong demographics and lower mortgage rates are setting the stage for a more robust housing market. Mortgage rates have been stable for nearly two months, but with continued deceleration in inflation, rates are expected to decline further. The economy continues to outperform due to solid job and income growth, while household formation is increasing at rates above pre-pandemic levels. These favorable factors should provide strong fundamental support to the market in the months ahead.

Information provided by Freddie Mac.

December Monthly Skinny Video

Mortgage Rates Inch Up but Remain in the Mid-Six Percent Range

January 25, 2024

The 30-year fixed-rate has remained within a very narrow range over the last month, settling in at 6.69% this week. Given this stabilization in rates, potential homebuyers with affordability concerns have jumped off the fence back into the market. Despite persistent inventory challenges, we anticipate a busier spring homebuying season than 2023, with home prices continuing to increase at a steady pace.

Information provided by Freddie Mac.

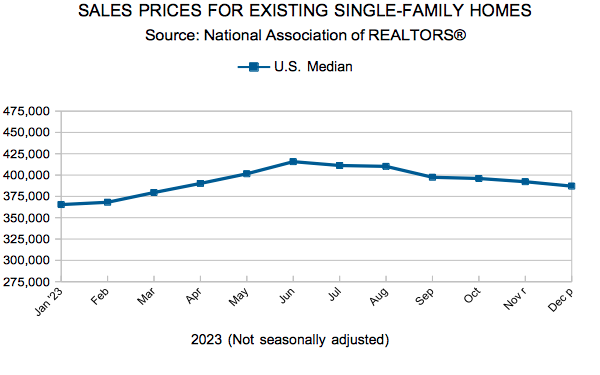

Existing Home Sales

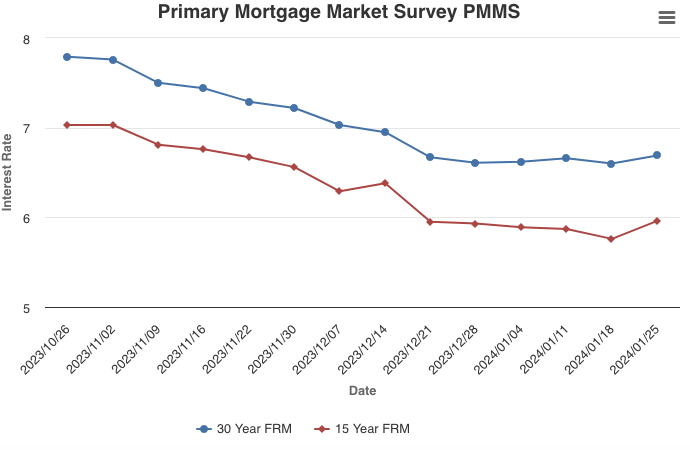

Mortgage Rates Decrease to Lowest Level Since May of 2023

January 18, 2024

Mortgage rates decreased this week, reaching their lowest level since May of 2023. This is an encouraging development for the housing market and in particular first-time homebuyers who are sensitive to changes in housing affordability. However, as purchase demand continues to thaw, it will put more pressure on already depleted inventory for sale.

Information provided by Freddie Mac.