Weekly Market Report

For Week Ending January 13, 2024

For Week Ending January 13, 2024

Fannie Mae’s Home Purchase Sentiment Index (HPSI) climbed nearly three points to 67.2 in December and was up 6.2 points year-over-year, according to the latest National Housing Survey®. The rise was attributed to increasing consumer optimism about mortgage rates, with a survey-high 31% of respondents indicating they expect mortgage rates will decline over the next 12 months. Homeowners, in particular, had greater optimism about the future of mortgage rates than renters, which could encourage some would-be sellers to list their homes this year, helping to increase the supply of existing homes for sale.

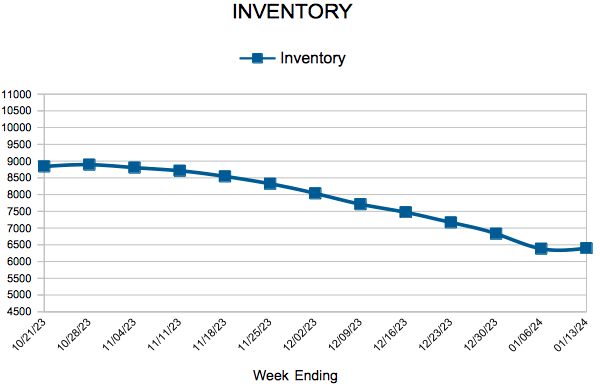

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 13:

- New Listings increased 14.5% to 900

- Pending Sales increased 2.6% to 560

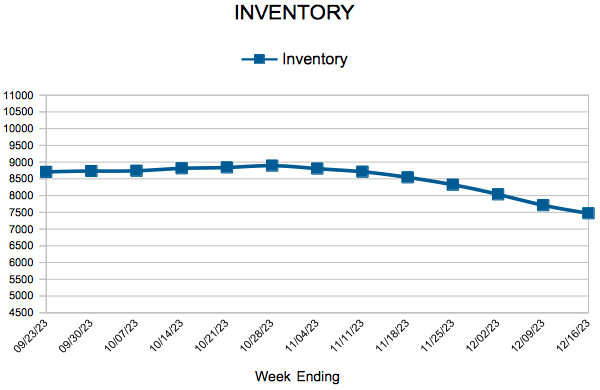

- Inventory decreased 4.2% to 6,397

FOR THE MONTH OF DECEMBER:

- Median Sales Price increased 1.3% to $353,700

- Days on Market remained flat at 50

- Percent of Original List Price Received increased 0.4% to 96.7%

- Months Supply of Homes For Sale increased 13.3% to 1.7

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending January 6, 2024

For Week Ending January 6, 2024

Median priced single-family homes and condos were less affordable compared to historical averages in 99% of counties nationwide in the 4th quarter of 2023, according to ATTOM’s Q4 2023 U.S. Home Affordability Report. Major homeownership expenses currently take up 33.7% of the average national wage, a slight improvement from the third quarter, when major expenses consumed 35% of the average national wage. ATTOM reports homeowners need an annual income of more than $75,000 to afford a home in approximately 57% of the county markets in the report.

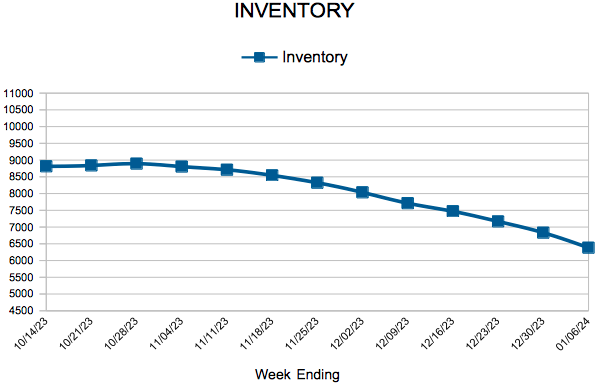

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING JANUARY 6:

- New Listings increased 3.9% to 853

- Pending Sales increased 19.3% to 476

- Inventory decreased 2.7% to 6,382

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.2% to $362,550

- Days on Market remained flat at 40

- Percent of Original List Price Received increased 0.2% to 97.4%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2023

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending December 30, 2023

For Week Ending December 30, 2023

U.S housing starts surged following the drop in mortgage rates, jumping 14.8% from the previous month to a seasonally adjusted annual rate of 1,560,000 units, according to the U.S. Census Bureau. The latest reading was boosted by an increase in single-family starts, which climbed 18% from the previous month. Housing completions were also up, rising 5% month-over-month. The average 30-year fixed-rate mortgage has fallen more than one percentage point since its peak in late October, leading to an increase in building activity and builder sentiment.

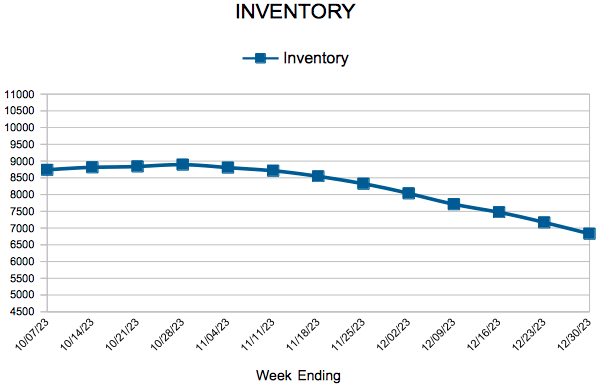

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 30:

- New Listings increased 6.7% to 366

- Pending Sales increased 1.2% to 413

- Inventory decreased 5.3% to 6,831

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.2% to $362,550

- Days on Market remained flat at 40

- Percent of Original List Price Received increased 0.2% to 97.4%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending December 23, 2023

For Week Ending December 23, 2023

The median household income for U.S. homebuyers hit a record high of $107,000 recently, a 21.6% increase from a year ago, according to the National Association of REALTORS® 2023 Profile of Home Buyers and Sellers. Despite higher home prices and rising borrowing costs, the share of first-time buyers also grew, increasing from 26% in 2022 to 32% this year. Down payments continued to climb as well, with the typical down payment for first-time buyers averaging 8%, the highest share since 1997, according to the report.

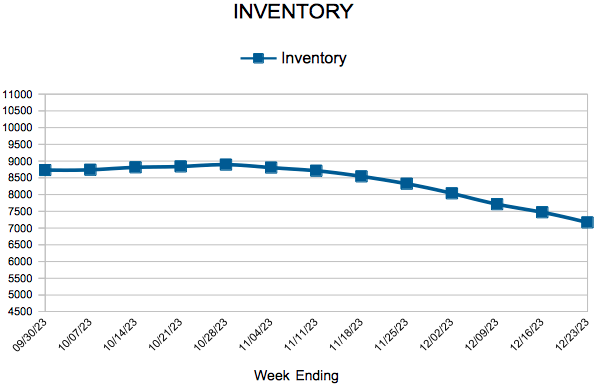

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 23:

- New Listings increased 37.3% to 453

- Pending Sales increased 20.7% to 571

- Inventory decreased 4.3% to 7,167

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.2% to $362,600

- Days on Market remained flat at 40

- Percent of Original List Price Received increased 0.2% to 97.4%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

Inventory

Weekly Market Report

For Week Ending December 16, 2023

For Week Ending December 16, 2023

47.4% of mortgaged residential properties were considered equity-rich—having at least 50% equity in one’s home—in the third quarter of 2023, according to ATTOM’s Q3 2023 U.S. Home Equity and Underwater Report. This marks a decline from the second quarter, when 49.2% of mortgaged homes were considered equity rich. However, the portion of homes that were seriously underwater recently improved, increasing from one in 36 homes in the second quarter of 2023 to one in 40 homes in the third quarter, the lowest point in more than four years.

IN THE TWIN CITIES REGION, FOR THE WEEK ENDING DECEMBER 16:

- New Listings increased 11.0% to 614

- Pending Sales decreased 1.4% to 614

- Inventory decreased 5.0% to 7,470

FOR THE MONTH OF NOVEMBER:

- Median Sales Price increased 2.2% to $362,600

- Days on Market remained flat at 40

- Percent of Original List Price Received increased 0.2% to 97.4%

- Months Supply of Homes For Sale increased 15.8% to 2.2

All comparisons are to 2022

Click here for the full Weekly Market Activity Report. From MAAR Market Data News.

- « Previous Page

- 1

- 2

- 3

- 4

- …

- 6

- Next Page »